At the August 25, 2025 meeting, the Midland School Board approved a resolution to place a Physical Plant and Equipment Levy (PPEL) on the November election ballot.

On Tuesday, November 4, 2025, our community will have the opportunity to vote on renewing the Midland Community School District’s PPEL. Approval of this measure would continue the current levy for another 10 years without increasing taxes.

More information can be found below, as well as in this video.

1) The Midland Community School District Board of Education is asking the community to renew the voted Physical Plant and Equipment Levy (PPEL) on Tuesday, November 4, 2025.

- A PPEL is a voter-approved levy that generates funds for infrastructure and equipment repairs, purchases, and improvements. Funds can only be used for these purposes. Most Iowa schools have had a voted PPEL in place for more than a quarter of a century.

- The voters may authorize a voted Physical Plant and Equipment Levy (VPPEL) for a period not exceeding ten years and in an amount not exceeding $1.34 per thousand dollars of assessed valuation. Midland Community School District has a voted PPEL of $0.67 and is looking to maintain that amount.

- If the PPEL is renewed by voters on November 4, 2025, the district would continue to use the funds to cover costs related to building and grounds maintenance, technology advancements, and other allowed expenses.

- The PPEL would ensure funds for another 10 years.

- The existing PPEL approved by voters will sunset on July 1, 2026 without renewal.

- If the PPEL is not renewed, the district would need to consider using general fund or SAVE money to support building upkeep, transportation, and technology, potentially delaying other projects.

2) Midland Community School District receives approximately $178,000 annually from its voter-approved Physical Plant and Equipment Levy (PPEL). The district relies on these funds to cover many crucial needs, such as:

- Ongoing maintenance for facilities, including roofing projects

- Security enhancements (secure entrances, cameras, door systems, etc.) to keep students safe

- Furniture purchases.

- Technology purchases such as computers, HVAC systems and other building systems (including plumbing, electrical, etc.)

- Bus, van and car purchases for student transportation

- Equipment purchases, including lawnmowers, floor scrubbers, and maintenance vehicles

- Instrument purchases

3) Renewing the levy will not increase the property tax rate.

- The MCSD tax rate will remain at $0.67 for the voted PPEL

- Renewing the levy will maintain, not increase, the current tax rate.

- The district wants to renew the voted PPEL at $0.67 per $1,000 of taxable value.

- The overall tax rate was $16.58 in FY 2025. This was reduced to $16.28 for FY26

- The district and its board continue to examine ways to minimize impacts on property taxpayers. By extending the district’s voter-approved PPEL, we will continue to make investments to protect our district’s assets and ensure our students continue to have the opportunities they need to succeed.

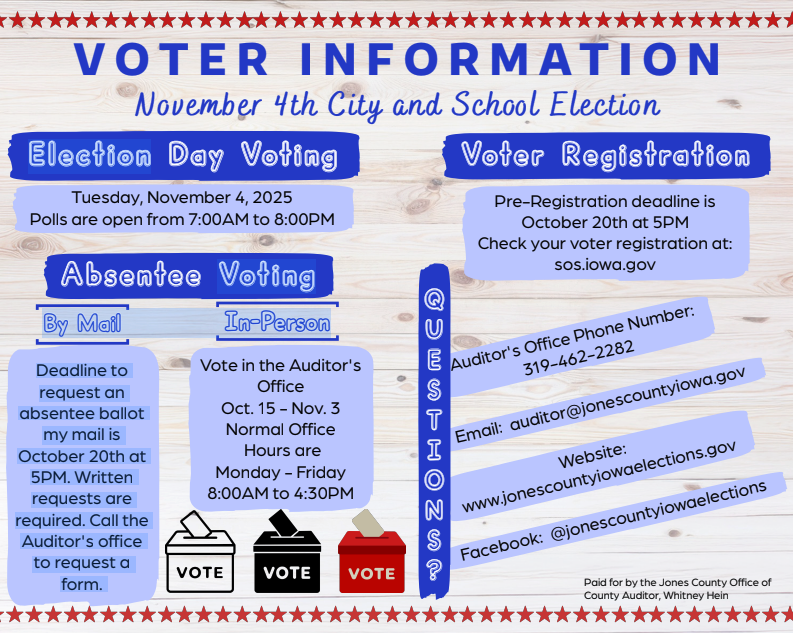

When and Where to Vote:

- Tuesday, November 4, 2025 at your designated polling location. Absentee ballot information will be available. Contact your County Auditor’s Office.

- Early/absentee voting begins Oct. 15, 2025

- Ballots may be requested by mail until 5:00 p.m., Oct. 20

- In-person absentee voting is available in the Auditor’s Office between 8:00 a.m. – 4:30 p.m. and ends 4:30 p.m., Nov. 3

- Election date is Nov. 4, 2025. Find your polling place.

What Will Be On The Ballot:

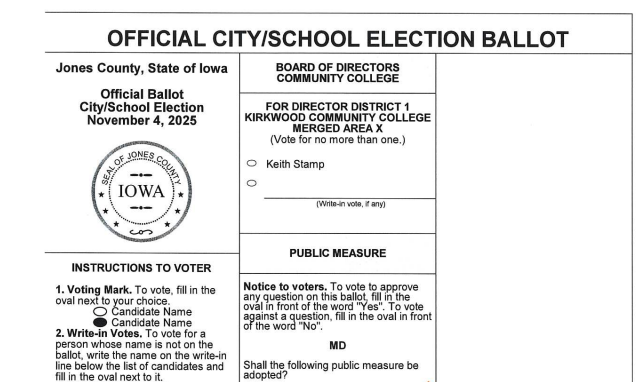

The question on the ballot will read as follows:

Shall the Board of Directors of the Midland Community School District, in the Counties of Jones, Cedar, Clinton and Jackson, State of Iowa, be authorized to levy an annual voter-approved physical plant and equipment property tax levy in an amount not exceeding one dollar and thirty-four cents per thousand dollars of assessed valuation of the taxable property within the School District for a period of ten years, commencing with the levy of property taxes to be made for collection in the fiscal year beginning July 1, 2026, to be used for any or all of the following purposes: for the purchase of grounds; improvement of grounds; construction of schoolhouses or buildings and opening roads to schoolhouses or buildings; purchase, lease or lease purchase of a single unit of equipment or technology as authorized by law; payment of debts contracted for the erection or construction of schoolhouses or buildings, not including interest on bonds; procuring or acquisition of library facilities; repairing, remodeling, reconstructing, improving, or expanding the schoolhouses or buildings and additions to existing schoolhouses; expenditures for energy conservation; rental of facilities under chapter 28E; purchase of transportation equipment for transporting students; purchase of buildings or lease-purchase option agreements for school buildings; equipment purchases for recreational purposes; payments to a municipality or other entity as required under section 403.19, subsection 2 (as amended); demolition, clean up and other costs if such costs are necessitated by a disaster as defined by and authorized by law; and any other purpose authorized by law now or in future to be paid from the levy?

A sample ballot can be viewed here, or by clicking the image to the right to enlarge.

More info will be available as we get closer to the vote. If you or a group have questions, please reach out to our Superintendent at dkoerperich@midland.k12.ia.us to set up a meeting or discuss via phone.

As always, thanks for supporting the Midland District.

More School Election Voting Resources: